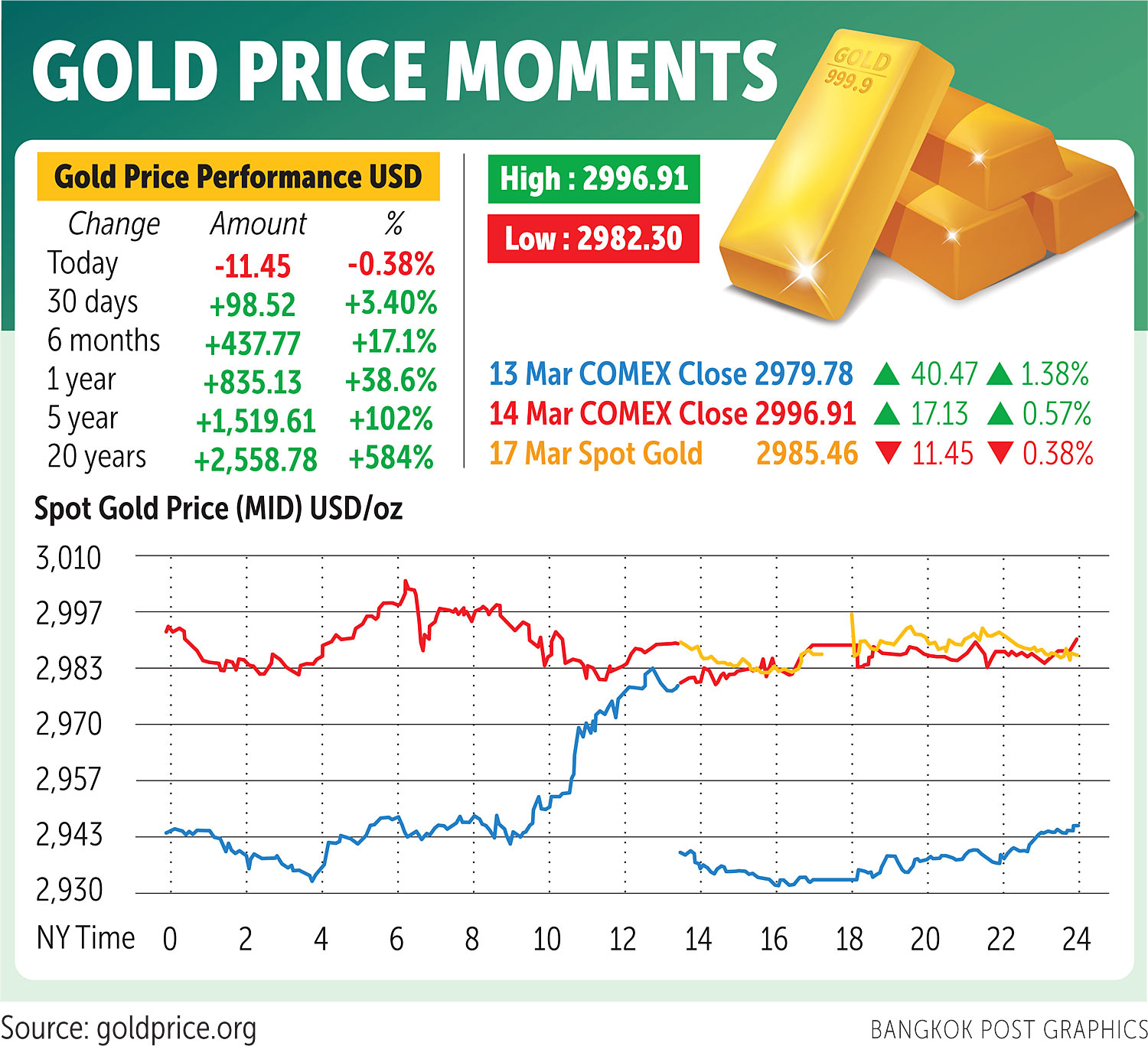

The US Federal Open Market Committee (FOMC) meeting, scheduled for March 18-19, is expected to be a crucial indicator of the stock market's direction alongside precious metal prices, following spot gold's record high of US$3,004.86 per ounce on Friday.

Nevertheless, following that rise, profit-taking caused a slight decline in gold prices, dropping 0.1% to $2,986.26 per ounce at 2.01pm Eastern Time (1.01am Bangkok time) on the same day.

The risk of a trade war and tariffs imposed by US President Donald Trump have driven investors to seek safe assets as a way to manage the economic uncertainty.

Gold is also supported by strong central bank demand, with major buyers like China increasing their gold reserves for a fourth consecutive month in February.

Domestic Gold Market

On the morning of March 17, 2025, Thailand's gold prices opened with a 100-baht increase, followed by a second adjustment at 10am, falling by 50 baht. Despite this, gold prices remained at an all-time high of 47,650 baht per one-baht weight (15.1 grams), matching Friday's level, after a one-time adjustment on Saturday led to a 150-baht decline.

According to the Gold Traders Association website, as of 10.25am, gold bars were being bought at 47,450 baht per one-baht weight and sold at 47,550 baht, while gold ornaments were being bought at 46,601.84 baht per baht-weight and sold at 48,350 baht.

Analysis and Predictions

Gold trader Hua Seng Heng reported that gold prices surged to an all-time high last week before experiencing a slight pullback. The price rally was driven by concerns over the global trade war, with Trump threatening a 200% tariff on imports of alcohol and wine from the EU.

Investor concerns about a potential economic slowdown have also played a role, particularly as US inflation figures for February -- both the Consumer Price Index (CPI) and Producer Price Index (PPI) -- came in lower than expected. This has fuelled speculation that the Fed may opt for further rate cuts. Meanwhile SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, increased its holdings by 12.07 tonnes last week.

This week, according to Hua Seng Heng, investors should closely monitor the Fed meeting, where the market expects the FOMC to keep interest rates unchanged, and pay attention to the Fed chairman's statement.

Technical Analysis

Analysts noted that there was slight selling pressure after gold prices tested the psychological resistance level of $3,000. However, buying pressure was expected to return yesterday. The recent decline in gold prices was due to short-term profit-taking, which is seen as a move to allow for further upward adjustments. Gold prices have support at $2,970 per ounce and resistance at $2,955 per ounce.

Hua Seng Heng analysts say the domestic price for gold bars has reached a new all-time high of 47,650 baht, marking an increase of more than 11.3% since the beginning of the year.

"While the price of gold bars may experience a slight decline, it is expected to continue rising thereafter. We recommend 'Let profits run'," the analysts said.

Broader Economic Impact

Pi Securities analysts said that gold prices reached a record high last week, driven by lower-than-expected inflation and reduced concerns regarding the trade war. However, gold prices are likely to slow down in the short term, depending on US economic data this week. Key factors to watch include US retail sales, which are set to be reported tonight, with the Bloomberg Consensus forecasting a 0.6% increase from the previous month.

The FOMC's decision, expected at 1am on Thursday, will be a key event.

According to the CME FedWatch tool, there is a 98% probability that interest rates will remain unchanged. However, the market is closely watching the Fed chairman's statement and clues on future rate cuts. If the Fed signals potential easing, it could boost global stock markets, gold, and currencies. However, if the stance is more hawkish, it may put pressure on riskier assets.

Market Updates

The baht continues to strengthen due to a weakening US dollar. The baht yesterday opened at 33.67 per US dollar, down slightly from 34.64 the previous day. Krung Thai Bank analysts expect the baht to fluctuate within a 33.35-34.10 range this week, depending on the Fed's decisions and upcoming US economic indicators.

Meanwhile, the Thai stock market remained volatile yesterday. As of 11.25 am, the SET Index stood at 1,169.22 points, down 5.24 points (-0.46%), with a total trading value of 15.1 billion baht.